Lehigh County Home Prices – 2025 Mid-Year Report

Are Entry-Level Buyers Getting Squeezed Out? Appraisal insights you can trust (and maybe even enjoy)

Robert G. Premecz, SRA

7/2/20252 min read

We’re halfway through 2025, and the Lehigh County housing market is showing signs of fatigue, friction... and maybe even a few warning flares.

Prices? Still edging upward.

Sales volume? Plunging.

And for first-time buyers? Buckle up—affordability is taking a hit.

Sales Volume: The Disappearing Act

Let’s talk inventory—or lack thereof.

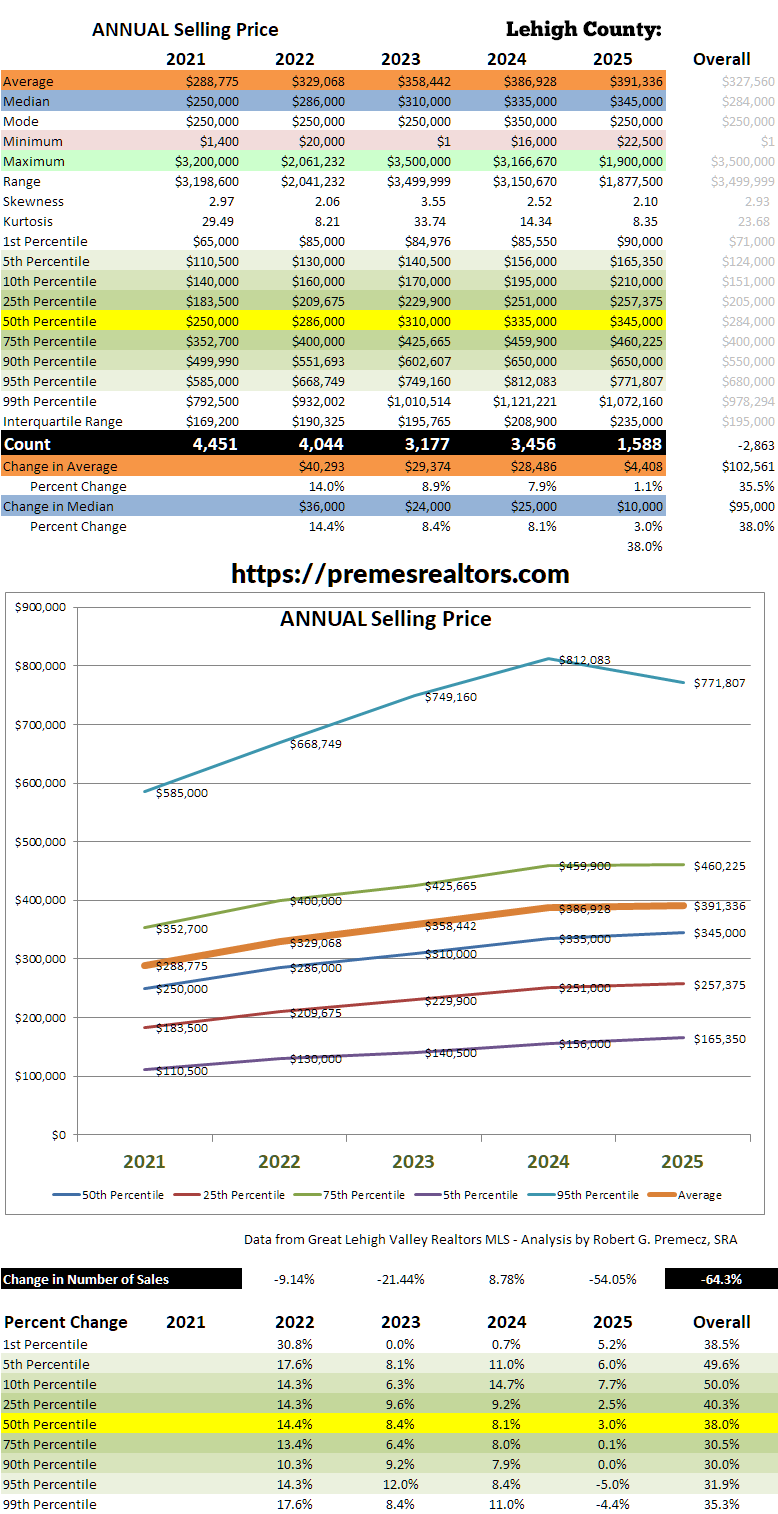

2021: 4,451 sales

2022: 4,044 (▼9.1%)

2023: 3,177 (▼21.4%)

2024: 3,456 (▲8.8%)

2025 (Jan–Jun): 1,588 → Annualized Estimate: ~3,176

→ Projected YoY decline: ▼8.1%

→ Since 2021: ▼28.7% overall

Takeaway: This is a sustained slowdown—not a blip. With fewer homes coming to market and buyers grappling with 7% mortgage rates, activity has ground down to a cautious crawl.

Prices Keep Climbing—But Who’s Benefiting?

Even with lower volume, prices continue inching up. Here’s where things stand in 2025 (January–June):

Average sale price rose from $386,928 in 2024 to $391,336, a 1.1% increase.

Median sale price climbed from $335,000 to $345,000, marking a 3.0% increase.

Mode (most common sale price) held steady at $250,000, unchanged from last year.

Who’s Gaining the Most? The Lower End Is Rising Fastest

The biggest price jumps since 2021 aren’t in luxury homes—they’re at the entry level, making affordability worse for first-time buyers:

5th Percentile (lowest 5%)

2021: $110,500 → 2025: $165,350

Increase: $54,850 (▲49.6%)

25th Percentile (lower quarter)

2021: $183,500 → 2025: $257,375

Increase: $73,875 (▲40.3%)

50th Percentile (median)

2021: $250,000 → 2025: $345,000

Increase: $95,000 (▲38.0%)

75th Percentile

2021: $352,700 → 2025: $460,225

Increase: $107,525 (▲30.5%)

95th Percentile (high-end)

2021: $668,749 → 2025: $771,807

Increase: $103,058 (▲15.4%)

Affordability Check: Entry-Level Buyers Are Losing Ground

Let’s be real: when the bottom 25% of the market is rising faster than the top, we’ve got a serious affordability crunch. First-time buyers and moderate-income households are absorbing the largest percentage jumps—without the benefit of rising wages or lower mortgage rates.

Here’s what that looks like:

A buyer in 2021 needed ~$110,000 for a 5th percentile home. In 2025? Nearly $165,000—that’s an increase of $54,850 for the cheapest slice of the market.

Median prices rose $95,000 in just four and a half years—a 38% increase.

Meanwhile, high-end homes have seen price deceleration, not acceleration.

Translation: Wealthier buyers may have options. First-time buyers are stuck in a pricing vise—and it's tightening.

What’s Changing Under the Hood?

Market Shape: Less skewed than the COVID-fueled frenzy, but still peaky.

Skewness: down to 2.10 in 2025 from 3.55 in 2023

Kurtosis: 3.35 (a sign of concentration around the middle range)

Luxury ceiling seems capped: Maximum sale this year ($1.9M) is far below 2023 ($3.5M).

Final Thoughts: The Market Is Two-Tiered—and Teetering

We're no longer in a runaway market, but we’re not exactly cruising either.

High-end homes are plateauing.

Low-to-mid homes are spiking in price—bad news for affordability.

Sales volume continues to decline, reinforcing the idea that "rate-locked" sellers and priced-out buyers are shrinking the playing field.

The engine’s still running, but the ride’s bumpier—especially if you're trying to buy your first home in Lehigh County in 2025.